Liquidity pool momentum trading: Benefit from bull markets while preserving capital during large drawdowns.

Identifying momentum and effectively trading it is a crucial element of a profitable trading strategy. Momentum trading has existed for years and will continue to do so due to our natural biases. In liquidity pools it is used by investing in risky liquidity pools when they are in an uptrend and by exiting to the safety of stable coin pools when in a downtrend.

In the video below, FLUIDEFI’s Financial Engineer, Abdennour Aissaoui deep dive’s into momentum trading and how it can work for investing in liquidity pools.

Originally published on Medium: Applying the Momentum Trading Strategy to Liquidity Pool DeFi Investing

The following points are covered:

Evidence-based hypothesis

Methodology

Assets universe

Portfolio construction

Benchmarks

Analysis period

In-sample parameter tuning

Analysis of the results (IN & out-of-sample)

Assumptions

The methodology used:

Network: Ethereum Mainnet

Platforms: Uniswap V2, Sushiswap, PancakeSwap, Uniswap V3

Liquidity Pools with Tokens: ETH, WETH, BUSD, USDC, USDT, DAI, FRAX, agEUR and at least $500,000 in liquidity

Portfolio creation will cover:

Layer #1: Relative momentum

Defined as the returns of an asset in comparison to other assets. This layer provides profitable trading opportunities

-> Buy the asset with highest return in our lookback period

Layer #2: Absolute momentum

Momentum of an asset relative to itself

Reduces volatility

-> A market timing strategy. Buy risky pools if and only if their return in our lookback period is positive.

Both layers are uncorrelated and add value.

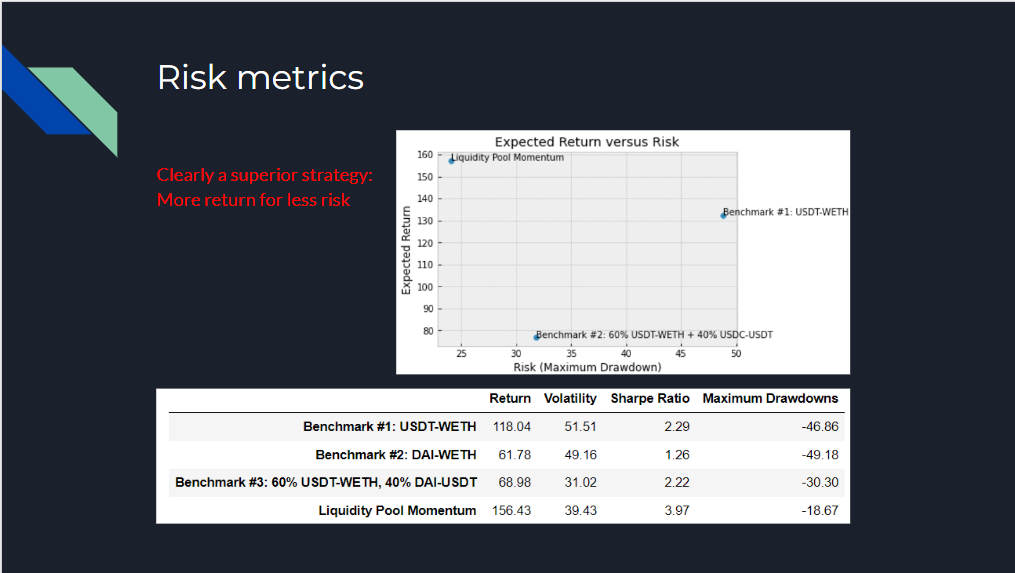

Benchmarks:

1. USDT-WETH (Uniswap V2)

2 60% USDT-WETH (Uniswap V2), 40% USDC-WETH (Uniswap V2) — Daily rebalancing

Analysis Period:

1. Past two years

2. In-sample period: Jul 2020 to Jan 2022

3. Out-of-sample period: Jan 2022 to Aug 2022

In-Sample Parameter Tuning:

— Optimal lookback period is 2 to 4 weeks.

— Rebalancing frequency does not seem very important — varies a lot

— Pick 3 week lookback period and a 2 week rebalancing frequency — optimal Calmar Ratio

Analysis of the Results:

Assumptions:

- No transaction costs

- Network fees

- Slippage

- No AMM fees

- No taxes

- Return is not impacted by AUM

- Discipline: Performance during market recovery could get painful

Trade carefully and be sure to follow FLUIDEFI for more DEFI EDU!

FLUIDEFI® is an award-winning SAAS platform that provides near real-time data aggregation & analytics, portfolio modeling, management, and trading signals for hundreds of thousands of decentralized financial (DeFi) digital assets. The advanced capabilities of the FLUIDEFI platform have been shown to reduce portfolio management time for DeFi traders by 75%. FLUIDEFI provides many layers of redundancy to achieve 100% accuracy on the most extensive set of DeFi analytics available in the market today.

Disclaimer: The information contained in this article and video is for informational purposes only and not to be construed as investing advice. The content of this video is solely the opinions of the hosts. Trading in cryptocurrencies is highly risky and could result in considerable loss. Anyone wanting to invest in cryptocurrency should seek the advice of a licensed financial advisor or registered investment advisor.