Blockchain Data, Applications,

& Infrastructure for Enterprises

FLUIDEFI enables institutions to deploy compliant digital asset solutions

Proven to reduce the time to launch compliant & confidential

products using DeFi digital assets from months to weeks.

Solutions

Compliant Digital Asset Solutions

FLUIDEFI provides compliant and secure technology to build bespoke digital asset solutions for financial institutions, auditors, lawyers, law enforcement agencies, and institutional data providers.

If you are considering launching a digital asset token or financial product, and your requirements include MiCA, VARA, ISO, SOC, GDPR, OWASP, IFRS, GAAP, classified processing, and/or quantum-ready security, then you should contact FLUIDEFI.

Enriched Blockchain Data Decentralized Finance (DeFi)

Not just indexed blockchain data, enriched analytics you wont find anywhere else.

Our patent-pending, AI-powered DeFi data enrichment technology provides actionable insights for decentralized finance applications.

FLUIDEFI's institution-grade data is GAAP/IFRS and MICA compliant due to its verifiability, auditability, and 192 decimals of precision.

Services

Blockchain Audit Services

FLUIDEFI provides blockchain audit tools for law enforcement, forensic accountants, treasury managers, and law firms.

DeFi AI Agents & AI/ML Solutions

FLUIDEFI's high-quality DeFi data trains & powers AI/ML agents with proven performance.

Privacy & Confidential Computing

Building secure centralized & de-centralized confidential computing infrastructures for blockchain applications (NVIDIA TEE, Intel TDX/SGX).

Enterprise DeFi Infrastructure

On-prem, cloud, and hybrid infrastructures, including bank-grade, classified & confidential processing (GCP, AWS, Azure, Digital Ocean, AliCloud, & more).

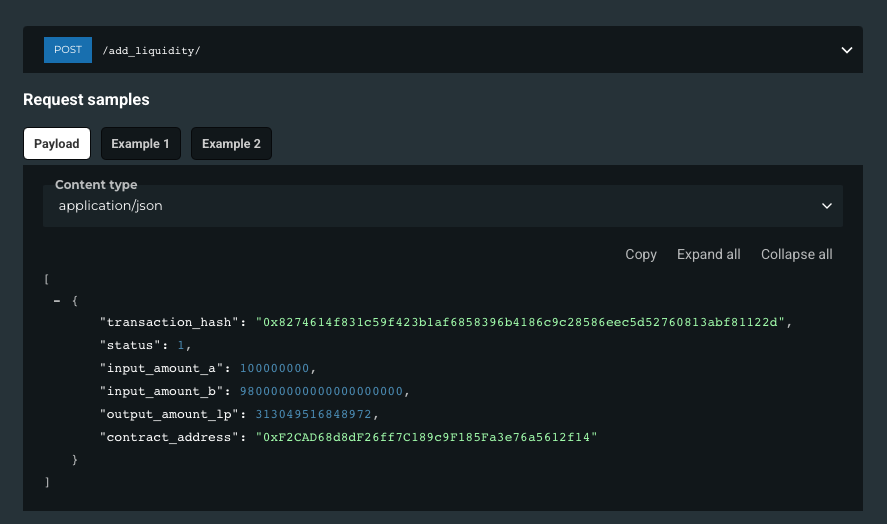

Explore the FLUIDEFI Documentation

Discover comprehensive guides, detailed API references, and integration tips to help you build, launch, and scale with FLUIDEFI. Everything you need to unlock the full potential of DeFi digital assets is just a click away.

View DocumentationAbout FLUIDEFI

FLUIDEFI is a multi-award winning Canadian fintech company that offers a premium white-label platform and decentralized finance (DeFi) data for building compliant digital asset solutions. Our clients include Financial Institutions, Law Enforcement, Institutional Data Providers, and Layer 1 blockchains around the world.

FLUIDEFI is built on patent-pending technology that provides verifiability, accuracy, AI/ML predictions, alerts, traceability, and energy savings.

Frequently Asked Questions

Have questions about FLUIDEFI? Check out our FAQ page for answers to common questions.